As we promised we prepared an overview for policy briefs dedicated to cryptocurrency The United Nations Conference on Trade and Development (UNCTAD) had released earlier in July. It is notable the this is the first time UN’s structures to pay close attention for the cryptocurrency adoption in the world despite of its spread all around the world since 2009.

The UN’s cryptocurrency risk assessment consists of three policy briefs:

-

«All that glitters is not gold: The high cost of leaving cryptocurrencies unregulated» examines the reasons for the rapid uptake of cryptocurrencies in developing countries, including facilitation of remittances and as a hedge against currency and inflation risks;

-

«Public payment systems in the digital era: Responding to the financial stability and security-related risks of cryptocurrencies» focuses on arguments why national digital payment systems that serves as a public good could fulfil the reasons for crypto use and limit the expansion of cryptocurrencies in developing countries.

-

The cost of doing too little too late: How cryptocurrencies can undermine domestic resource mobilization in developing countries explains how cryptocurrencies could enable tax evasion and avoidance through illicit flows and may curb the effectiveness of capital control.

UNCTAD makes a conclusion that cryptocurrencies bring mostly threats to the emerging markets as in the lack of governmental control they can be used for diverse illicit activities. It is stated that from September 2019 to June 2021, cryptocurrency ecosystems expanded by more than 2300% and the global adoption of cryptocurrencies during the coronavirus (COVID-19) pandemic has increased exponentially.

According to the Policy Brief #100, the most significant surge in cryptocurrency adoption occurred in Ukraine, Russia, and Venezuela. In these countries digital currency ownership as share of population exceeded 10%.

The report highlights two main reasons for the increased use of cryptocurrencies in developing countries during the pandemic. First, the use of cryptocurrencies was an attractive channel, in terms of price and speed, through which to send remittances. During the pandemic, the already high costs of traditional remittance services rose even higher during lockdown periods due to related disruptions.

By the way, that was one of the main reasons for El Salvador to adopt Bitcoin as a legal tender and as a national currency.

Second, cryptocurrencies, as part of financial investments and speculation, are mainly held by middle-income individuals in developing countries and, particularly in countries facing currency depreciation and rising inflation (triggered or accentuated by the COVID-19 crisis), cryptocurrencies have been perceived as a way to protect household savings.

Nevertheless, according to the report, all benefits of cryptocurrencies are overshadowed by the risks and costs they pose in developing countries. The use of cryptocurrencies may lead to financial instability risks. If prices plunge, monetary authorities may need to step in to restore financial stability.

In developing countries, the use of cryptocurrencies provides a new channel for illicit financial flows. Also, it undermines the effectiveness of capital controls, an essential instrument in developing countries with which to curb the build up of macroeconomic and financial vulnerabilities, as well as to increase policy space.

Finally, cryptocurrencies may become a widespread means of payment and even replace domestic currencies unofficially, which could jeopardize the monetary sovereignty of countries.

As a possible response to the spread of cryptocurrencies in developing countries UNCTAD in the Policy Brief #101 discusses on how central bank digital currency (CBDC) or fast retail payment system may reduce the necessity of cryptocurrencies in the country. As there is still not much experience in CBDC adoption in the world authors find more advantages in fast retail payment systems.

In fast retail payment systems central banks take on three crucial roles, namely, as designers, overseers, and operators. If well designed, overseen and operated by a central bank, a fast retail payment system can meet the requirements of a digital payment system, but may fall short in terms of financial inclusion, as it requires intermediaries to offer accounts to users. The advantage of a fast retail payment system, compared with other payment streams, is that it may be provided at no cost or a low cost. The use of an alias (taxpayer identification number, telephone number or email address) can be used to identify the payee instead of a bank account number. This makes access to fast payments easier and reinforces the safety and integrity of the system, as it helps to reduce fraudulent activity and payment to an incorrect payee.

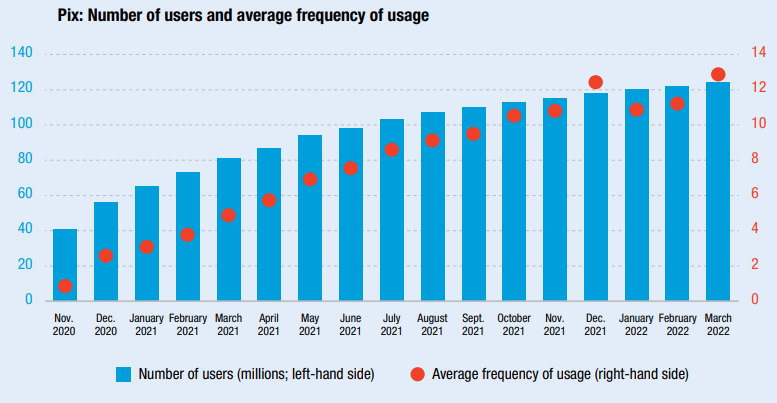

As an example, the experience of The Central Bank of Brazil in developing and adopting its fast retail payment system «Pix», is given.

The Central Bank of Brazil launched the fast retail payment system Pix in November 2020. The system, owned and operated by the central bank and implemented after over two years of development, is accessible to anyone holding a transaction account at a bank or other intermediary. Pix provides a number of advantages, including that it is faster and cheaper than other payment alternatives in Brazil; 99 per cent of payments are completed within 0.6 seconds and there are no fees for individual transfers. The number of users increased from 40 million in November 2020 to 128 million in March 2022, representing two thirds of the adult population.

In countries in which financial inclusion levels are already high, or in which financial institutions can successfully extend transaction accounts to the population, a fast retail payment system can serve as a system that has some of the advantages of a central bank digital currency.

From the other side, the Policy Brief #102 is dedicated to major threats cryptocurrencies may bring:

- new ways for illicit financial flows;

- new ways for tax evasion and capital concealment;

- decrease in efficiency of capital control.

The key difference between fiat and cryptocurrencies is that international transfers of cryptocurrencies do not rely on banks or related legal and accounting services. Instead, cryptocurrency transactions are often channelled through unregulated cryptoexchanges. Hence, cryptocurrencies are under-regulated, enabling individuals to bypass tax authorities’ efforts to address offshore tax evasion. In effect, cryptocurrencies can serve as new tax havens.

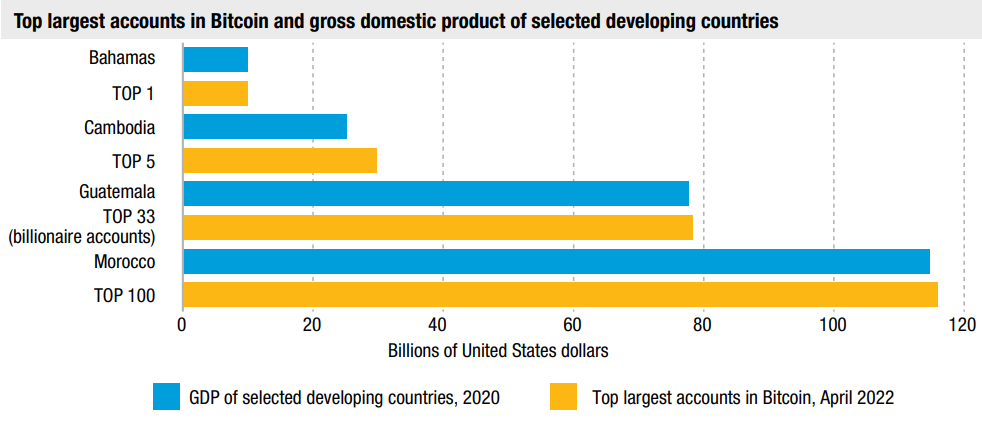

The size of the largest Bitcoin account (as at April 2022) is equivalent to the 2022 gross domestic product (GDP) of the Bahamas, and together the biggest 33 Bitcoin accounts with over $1 billion each correspond to the GDP of Guatemala (US$78 billion in 2020). The top richest 100 Bitcoin addresses account together for US$115 billion, equivalent to the GDP of Morocco (US$114 billion in 2020) and greater than the GDP of 135 individual countries.

The report notes that the developing economies don’t have strict regulation framework for digital assets and that may cause such significant risks. It should be noted that the UN’s body for the first time gives recommendations for digital financial assets adoption. To minimize the risks inherent in cryptocurrencies, it is proposed to ensure a comprehensive regulation for digital assets:

- require the mandatory registration of crypto-exchanges and digital wallets and make the use of cryptocurrencies less attractive, for example by charging entry fees for crypto-exchanges and digital wallets and/or imposing financial transaction taxes on cryptocurrency trading;

- ban regulated financial institutions from holding stablecoins and cryptocurrencies or offering related products to clients;

- restrict or prohibit the advertisement of crypto-exchanges and digital wallets in public spaces and on social media;

- create a public payment system to serve as a public good, such as CBDC or fast retail payment system.

The UN is cautious about digital assets, which is expressed in the presence of recommendations to ban their advertising or the provision of services. However, the practice of the largest economies in the world just demonstrates that high-quality regulation is much more effective than a complete or partial ban, as it creates favorable conditions for legal business, which stimulates the development of the industry and the growth of the national economy.

However, no matter what laws are adopted, one should not forget about the necessity to conduct a risk assessment in case there is an intention to invest in any of the variety of crypto-assets.

Successful investments in cryptocurrency projects and don't forget to check addresses for risks, it can help to save your funds! You can also report us any cases related to fraudulent cryptocurrency addresses and the considered risks at TokenScope via «Reporting a cryptocurrency address» form. This will help to protect other users from the risks of interacting with such addresses and their owners.