Until last Friday Silicon Valley Bank (SVB) was the 16th largest bank in the US, worth more than $200bn and it was shut down by the Californian regulator for loosing all its capital. The collapse of the SVB was preceded by the closure of Silvergate bank, another California bank which also served high-tech and crypto companies. Another similar bank, a New York-based Signature Bank has also ceased operations earlier this week.

The SVB collapse is the largest US bank failure since the 2008 financial crisis, roiling global markets and stranding billions of dollars belonging to companies and investors.

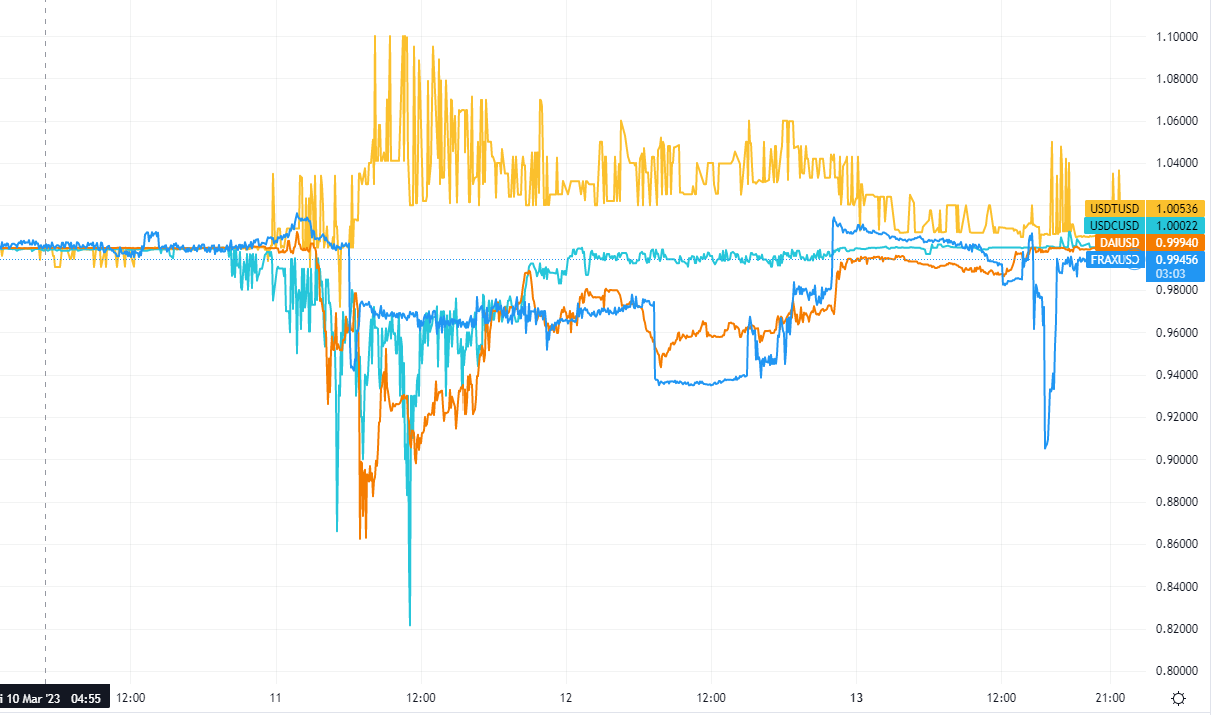

The second largest Stablecoin USD Coin (USDC) lost its dollar peg and slumped to $0.82 after Circle, the coin’s emitter, revealed about 8% of its reserves were held at SVB.

The USDC instability causes domino effect on other stablecoins such as DAI and FRAX which use Circle’s coin in their collateral. DAI, a stablecoin issued by MakerDAO, lost 7.4% of its value due to USDC’s depegging as USDC represented 51.87% of its collateral.

Fractional-algorithmic stablecoin Frax (FRAX) shared a similar fate due to adverse market sentiments and responded to the USDC sell-off with a drop to trade at $0.885.

Taught by the crisis of 2008, the US financial regulators acted promptly this time. On Monday, March 13, the Federal Deposit Insurance Corporation (FDIC) took unprecedented measures and announced that all deposits both insured and uninsured of the collapsed banks will be guaranteed. The FDIC stated that transferred all deposits and substantially all assets of the former Silicon Valley Bank to a newly created, full-service FDIC-operated «bridge bank» in an action designed to protect all depositors.

By the way, in the USA all deposits are insured up to $250,000 worth and 90% of deposits in SVB were uninsured. President Joe Biden also spoke on this occasion, adding that the management of the collapsed banks would be fired, and the authorities are not going to save the banks’ shareholders.

As finance regulators secured all deposits of the collapsed banks, especially SVB, the USDC stablecoin regained its peg to the U.S. dollar.

The community of MakerDAO has also responded quickly to the crisis by holding an emergency vote and approving a proposal to adjust the parameters of the protocol, limiting USDC's influence on the DAI stablecoin. Notably, that DAI restored its peg to the U.S. Dollar even faster than the USDC. FRAX spent the most time to return its $1 price.

Tether (USDT) also lost its peg to the dollar, gaining 10% at the time of the highest demand. So, what happened to the SVB and other banks that collapsed this week?

As popular banks for the tech sector, their services were in hot demand throughout the pandemic years. The market shock of COVID-19 in the beginning of 2020 gave way to a wealthy period for startups and established many new tech companies, as consumers spent a lot on digital services.

The majority of tech companies used such banks as SVB or Silvergate to hold cash they used for payroll and other business expenses, leading to an influx of deposits. These banks, like many others, invested heavily in long-dated US treasuries, including bonds backed by mortgages.

But bonds have an inverse relationship with interest rates; when rates rise, bond prices fall. So when the Federal Reserve started to hike rates rapidly to combat inflation, the SVB bond portfolio started to lose significant value. Same time investors started to flee from risky assets such as crypto.

The crypto winter has begun. Bitcoin accelerated its fall and, while at the beginning of January 2022 the cost of the first cryptocurrency was $45,000, in July it was already at the level of $19,000.

If Silvergate, SVB and Signature were able to hold those bonds for a longer period until they mature, then they could receive their capital back.

On Wednesday San Diego-based Silvergate Bank announced its self-liquidation. The bank was well-known in the crypto industry due to its Silvergate Exchange Network (SEN), a financial platform that was used by customers to transfer money to crypto exchanges. Many U.S. crypto-exchanges were clients of the bank, including FTX, the collapse of which played a key role in the loss of liquidity by the bank.

FTX clients began to run from the exchange trying to release their funds that were deposited by FTX in the Silvergate Bank. To meet the demand of depositors for cash, the bank began selling off its liquid assets - treasury bonds. It was forced to sell them at a loss, since they were still bought at an almost zero rate, and due to its increase, their value fell at the moment. By the end of the year, the bank recorded a loss of $1 billion, which affected the confidence of its depositors. The funds outflow continued leading the bank to the capital loss in March 2023.

Same way, SVB and Signature banks were shot of cash on hand, and started selling some of its bonds at steep losses until their collapse.

Due to the fact that the US authorities guarantee the safety of all deposits, it seems that the crisis is over. Moreover, cryptocurrencies seems to look like a some kind of protection against problems of the banking system as the Bitcoin price rose to $26000 on Monday.

Stablecoins, especially DAI, also demonstrated their resistance to the crisis and quickly regained the peg to the U.S. dollar. Perhaps soon bitcoin and stablecoins will not be risky, but defensive assets competing the US dollar.