Crypto regulation in the world: weekly digest #64

The EU

The EU has published a comprehensive report with an overview of the crypto regulation in the EU-partner countries focusing on the United States and the United Kingdom. The report «Non-EU countries' regulations on crypto-assets and their potential implications for the EU» discusses the regulatory frameworks for crypto-assets in non-EU countries and their potential implications for the EU.

The EU adopted a comprehensive regulatory framework on markets in crypto-assets (MiCA) in June 2023, which will regulate crypto-asset markets. However, EU Commissioner Mairead McGuinness has expressed concern over the lack of regulation in third countries and its potential impact on financial stability.

The United Kingdom has also adopted comprehensive legislation on crypto-assets (FSMA), with a strong commitment to becoming a «crypto hub» and attracting global activities. However, the new law does not enact detailed regulation, which is left to the national financial authorities.

In the United States, from the other side, crypto-assets are subject to the financial markets supervisor only if they qualify as a security. However, the various cases have proved that such qualification could vary, creating legal uncertainty. Moreover, the applicable regulation is that for securities, not financial institutions.

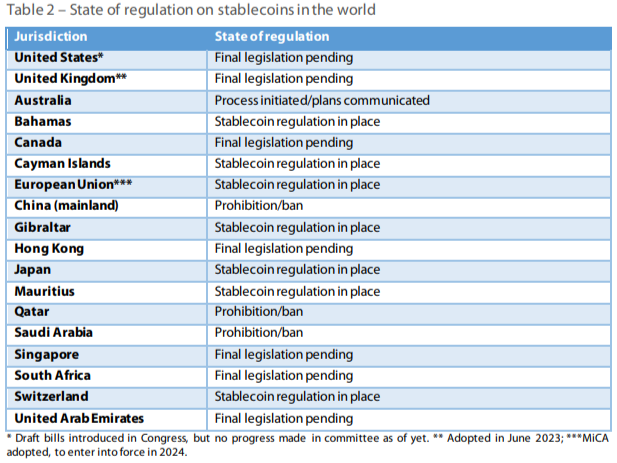

The report also overviews the global regulatory landscape, countries are taking a great variety of approaches to the rise of crypto-assets; at least 19 sovereign jurisdictions have taken action on them so far. Extremes range from China's comprehensive ban on all non-state activities, including the provision of trading services and private DLT infrastructure, to the previously discussed gradual and uncertain application of existing regimes to these novel instruments, as in the US.

Overall, there is an evidence that a tighter regulatory framework has limited but positive effects on crypto-assets markets. The EU's MiCA regulation aims to protect consumers and investors while ensuring financial stability and supporting innovation. The regulation covers issuers and service providers and a majority of crypto-assets types.

The report highlights the need for stricter oversight in the crypto industry to prevent money laundering and financing of terrorism. The EU's MiCA regulation and the «Travel Rule» requiring exchanges to share customer details are meant to protect consumers, counter fraudsters, and promote market integrity. The EU's MiCA regulation is more comprehensive and innovative than the regulations in non-EU countries.

Hong Kong

Hong Kong is set to issue guidance on tokenizing authorized investment products in the near term. Christina Choi, the Executive Director of Investment Products at Hong Kong’s Securities and Futures Commission (SFC), shared this information during a speech. The SFC is actively working on this guidance, and primary trading of tokenized SFC-authorized products would be the most suitable to be permitted initially, given the early stage of development of the virtual asset trading platforms (VATPs) regime in Hong Kong.

However, tokenization would introduce new risks and raise legal, regulatory, and supervisory challenges associated with the use of this emerging technology. Secondary trading of tokenized SFC-authorized products on VATPs would require more caution and careful consideration. Hong Kong has recently implemented new regulations to govern the trading of cryptocurrencies. The new rules allow retail investors to trade coins on exchanges licensed by the SFC. The SFC has also issued guidance on the licensing of cryptocurrency exchanges, which requires exchanges to meet strict criteria on which virtual assets can be bought and sold.

News from other countries:

-

The US SEC has postponed its decision on all Bitcoin ETF applications until the next year. The SEC is still gathering public comments on the proposal and has not made a decision yet.

-

VanEck, a major asset management firm, is preparing to launch an Ethereum futures ETF called VanEck Ethereum Strategy ETF (EFUT). The ETF will invest in standardized, cash-settled ETH futures contracts traded on commodity exchanges registered with the CFTC.

-

Binance has announced its full exit from Russia by selling its firm to a newly launched crypto exchange business known as CommEX. The off-boarding process for existing Russian users will take up to one year, and all assets of existing Russian users are safe and securely protected.

We continue to highlight the news of the world of crypto regulation worldwide. Please stay with us!